How to hire a financial professional for your business?

Nowadays, the demand for financial professionals in Dubai is continuously increasing. Hiring a team of financial professionals, you can entrust with day-to-day customer duties frees you up to focus on higher-level activities that will help the company expand and increase profitability.

Financial professionals must possess both technical skills and interpersonal skills in order to handle a wide range of investment management and financial planning responsibilities.

Financial professionals should also possess the interpersonal skills and professional values necessary to build strong relationships with clients and colleagues.

3 major tactics that you should know when hiring financial professionals:

-Use a thorough job advertisement to attract potential candidates.

-Use a blacklist procedure to filter the most suitable applicants.

-Identify your requirements and ask the right questions to select the best applicants from the list.

Begin with a detailed Job Description

If you want to employ financial professionals, you will need to know how to design a job description that clearly defines the position, duties, and expectations.

You might refer to other financial professional job descriptions to get an idea but it’s best to tailor yours so you can attract people who are qualified for the position and ready to join your business.

Step 1:

Begin with a brief description of the job and why your organization is a wonderful place to work. You must stand out from the crowd in order to get the attention of top performers.

As a result, you’ll want to include things like your company’s objective, achievements it’s received, and benefits like bonuses, provident fund, and professional development opportunities that will encourage top people to apply.

Step 2:

Then, make a list of the key responsibilities so that the finance professional is aware of the day-to-day obligations and can assess if they have the relevant expertise and abilities.

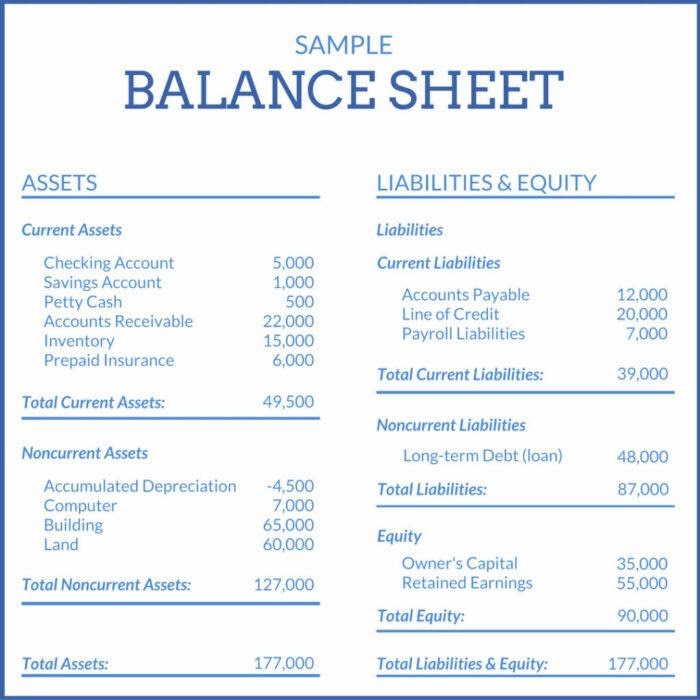

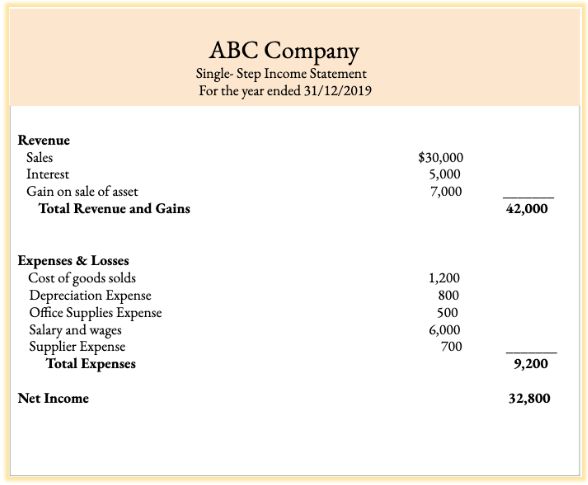

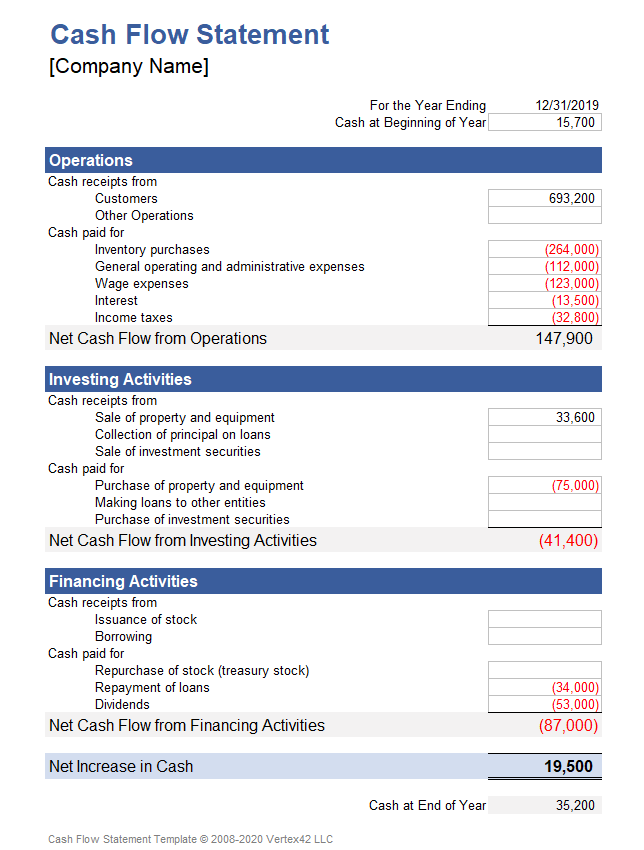

Financial professionals may be in charge of making investment and asset allocation recommendations, tax and estate planning, cash flow analyses, and assisting clients in developing financial plans.

A financial professional may oversee a team, drive customer interactions, and produce new business, depending on their seniority.

Step 3:

Next, clearly mention if you are expecting any specific requirements for the post. This could be any certification, licenses or even an educational qualification related to business management and knowledge regarding small and medium scale businesses.

Step 4:

Some people will only apply for a job if they satisfy all of the requirements, therefore separating the needed credentials from the recommended qualities will assist to attract more prospects to apply.

Selecting top financial professionals from the resumes

After you post the job description, you might have to go through a lot of resumes to find the best applicant who is suitable for the position. If you have knowledge about the black listing procedure (excluding unacceptable resumes) it will be easy for you to filter the most fitting applicants.

You can also use an application tracking system (ATS) and resume screening technology to filter for keywords from the job description, such as business management, client services, portfolio management, or financial modeling, to make the selection process more efficient.

As the final step of selecting an applicant you can conduct phone or online platform-based interviews (example: zoom or MS teams interviews). A quick call should help you assess several soft qualities that all financial professionals should possess, regardless of their level of seniority, such as being pleasant, professional, and communicative.

The phone conversation allows you to go through more duties and specifics with the prospect, including as salary ranges and benefits so they can determine whether they’re interested.

Interviewing the applicant by asking insightful questions

First and foremost, you should have a clear idea about your needs and requirements. Once you identify them it will be easy for you to ask questions from the applicant.

Then, you will have to discover if the finance professional has the necessary experience, abilities, and professional values to thrive in the position at your firm.

Here are some sample interview questions for finance professionals:

-How would you go about developing a financial strategy for a new client? What would you require from them in terms of information?

-What tools do you use to keep up with the stock market and financial news?

-What stock would you buy today if you were starting a new investment portfolio? And why?

-Do you feel confident in your ability to manage a customer relationship?

-In past positions, what account management responsibilities were you in charge of?

-What challenges did you confront in your past positions? What was your strategy for dealing with them?

-What characteristics do you possess that make you a successful finance professional?

-What brought you to this position in the first place?

You can also hire experienced finance professionals from KLOUDAC. You can easily sign up to hire the best finance professional.

KLOUDAC Accounting Firm Dubai, UAE

KLOUDAC is a recognized accounting firm in Dubai, UAE with 15 years of service experience. We have built connections with over 500 customers. It has also won the certification of Xero Payroll and certification of Xero advisor from the world leading online accounting software – XERO. Moreover, KLOUDAC is a golden champion partner of Xero. Accounting and Bookkeeping is more convenient for the SMEs via KLOUDAC since they provide their clients with a whole package of services such as Financial Consultancy, Business setup, Audit and assurance services, Taxation services, Recognized accounting software and more.