XERO Accounting for your business in Dubai, UAE

We have been awarded XERO Gold Champion Partner status by XERO; the world’s leading cloud accounting software for SMEs.

Xero Dubai – Taking care of all your accounting needs

In the last few years, the way our workplaces operate has undergone a drastic transformation. With work from home or remote working becoming a widely accepted norm, and businesses across the globe going geographically agnostic, things in the physical workspaces have had to adapt to the changing dynamics.

This has enforced offices to become anytime, anywhere ready in their approach – both in terms of workforce and infrastructure. This changing environment has brought about rising demand for cloud-based software systems that can be accessed seamlessly irrespective of time zones and geographical boundaries.

One such software that has gained immense popularity in the accountancy world is Xero, an accounting platform known for its safety, ease of use, and accessibility. So, if you need to streamline your accounting needs in Dubai, let Xero Dubai handle the requirements while you concentrate on your business.

So, what is Xero?

Xero is an extremely useful and cost-effective tool, specially designed for small and medium-sized businesses. It helps companies with manpower constraints to get accounting work done through automation and AI-based inputs. As Xero is a cost-effective solution, it comes in handy for businesses that might not have the economic strength to have a separate accounting department.

It also makes handling accounting rather easy because of its cloud-based nature, which means that organizations can work with accounting professionals from anywhere. Xero implementation gives businesses a lot of freedom and independence to handle their accounting needs without having to spend a bomb.

Benefits of Xero Implementation

Any software is developed to make the workflow easier, and that’s exactly what Xero does.

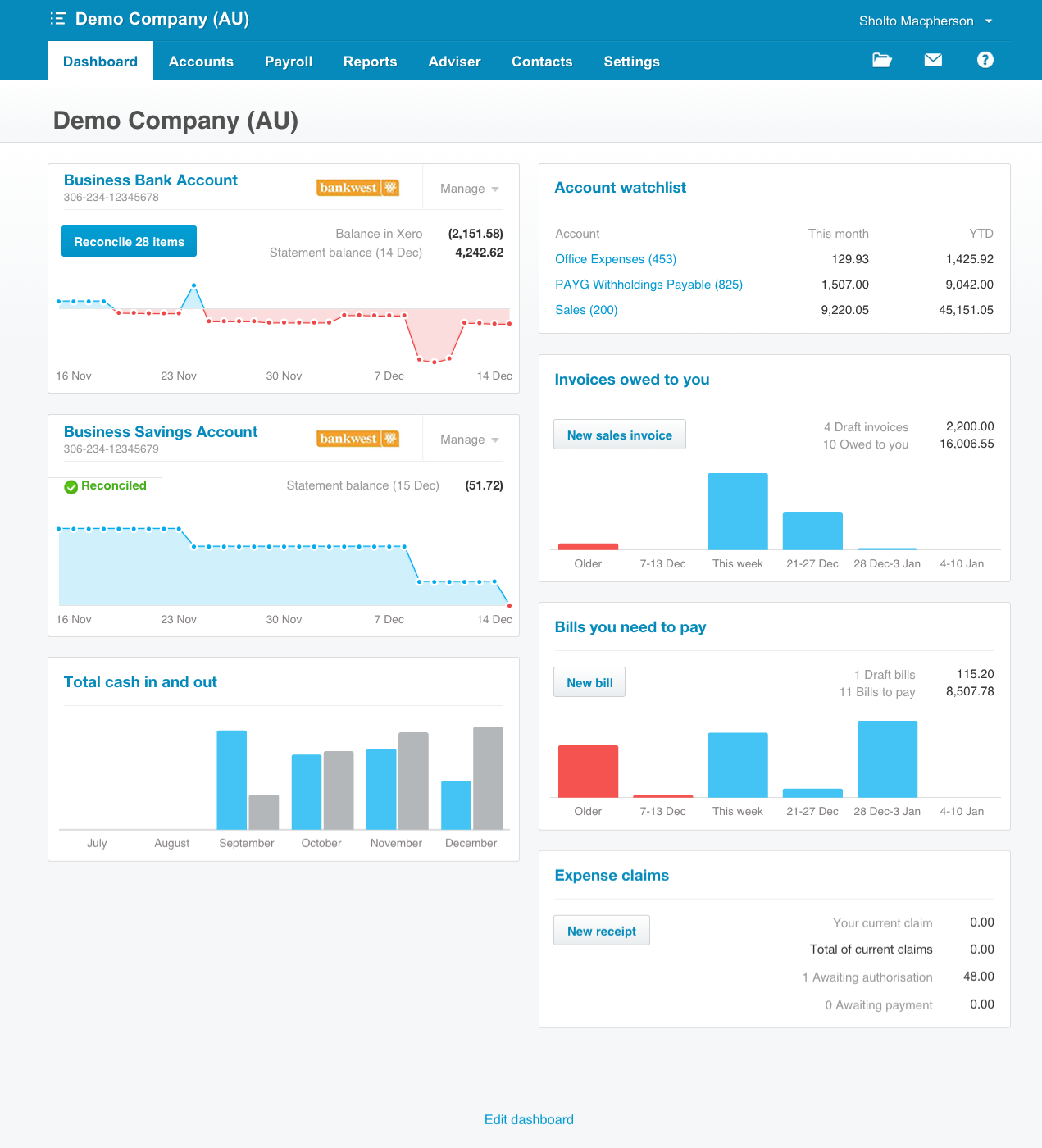

Unlimited creation & sending of invoices

It is rather difficult to keep a check of invoices from various platforms. Connecting Xero with your account allows you to categorize and import your latest bank, credit, and PayPal transactions.

Automates manual tasks

Xero automates several manual tasks like data entry that require long man hours. With Xero, you can work smarter and faster without having to spend time and effort on time-consuming tasks.

Auto updates, for free

Xero upgrades itself at regular intervals so that you don’t have to worry about keeping the software in sync with the latest accounting trends.

Xero Implementation – Easy, simple, and effective

As software that has been developed to better streamline accounting work, Xero implementation is just what you expect it to be – easy, simple, and effective.

Highest level of security

Security is one of the biggest concerns for businesses in today’s time when online threats are becoming more and more common. Xero Software Dubai provides bank-level security to ensure that your important data is safe and secure at all times.

Collaborate with Xero team Dubai

Xero makes it easy to collaborate with service providers so that your accountants and bookkeepers can view your accounts and provide real-time inputs. It also gives you the option of controlling each team member’s access.

Why collaborate with a Xero Dubai service provider

Accounting is a serious business and small and medium-sized businesses often find themselves struggling to keep their finances in place in the wake of limited manpower. As Dubai makes hefty inroads into the startup and entrepreneurship environment, there are several such small and medium-sized businesses looking for accounting and bookkeeping support, which is what a Xero UAE service provider can deliver.

These are firms that have partnered with Xero and hence have the rights, knowledge, expertise, and extended support to operate the software. Such firms have the right wherewithal to handle accounts of any size and provide assured, safe, and quick services so that you don’t have to worry about your accounts. It is always better to let an expert handle your accounts; this is where all the money lies.

How it’s works

Provide Info

Xero implementation begins with providing the required information and filling up the form. This allows your accounting partner to understand your business and chart out a plan

Actual implementation

Implementing the software is the next step which requires a couple of weeks to incorporate your unique business requirements

Training

This step is all about finding your feet by using the powerful features that Xero provides. Getting familiar with them so that you can make the most of them

Set & support

Your collaborator will provide extended and ongoing support to help you sail through any issues that you might face

Xero is a cloud-based accounting software which supports accountants and bookkeepers to collaborate with their small business clients via online.

This accounting software provides number of features like paying bills, claiming expenses, accepting payments, capturing data, reporting and many more. Xero is also one of the fastest growing SaaS companies globally.

Furthermore, it also gives you accessibility to real-time account information and business tools from your own device. Which enables you to make decisions faster.

Xero for Accountants and Bookkeepers – Xero allows you to Collaborate with the clients, automate the tasks and access client record any time making the work easier and faster.

XERO Data Security

The data that is shared with Xero accounting software will be 100% secured even if your device is lost by any chance. Data security is ensured via the accounting consultants in Kloudac.

Accounting Firms Recognized by Xero in Dubai, UAE

Xero and Kloudac is in partnership since 2017. Kloudac is a fast-growing accounting firm in Dubai that provides Bookkeeping, VAT consultancy, and many more facilities by giving hand to hand support to SMEs.

Xero being one of the top recognized accounting software globally, has given approval and recognition for Kloudac accounting firm in Dubai, UAE.

Kloudac has won the gold champion partnership with Xero.

Certifications

- Kloudac has won the certification of Xero Payroll which certifies that it has the experience and knowledge of setting up payroll proficiently and running the payroll process smoothly.

- It has also won the Xero advisor certification which ensures that Kloudac has a solid understanding and realistic knowledge of how to use Xero with clients.