UAE is one of the most attractive and safer destination to live, work and set-up business. One main reason for this is the declaration that the UAE is ‘tax free’. As a result, if you are a UAE resident working and living in the UAE, your UAE earnings are likely to be tax-free.

Dubai income Tax

Individuals in the UAE are not subject to income tax. Which means that you are a resident living and working in the UAE, then this means your UAE earnings are tax free. But if you are an expat, then there are limitations. For more details, have a look at “Taxation based on your Tax residency” and “Are you a tax resident in Dubai?” sections of this blog.

Major Tax Types in Dubai

Corporate tax – Each Emirate has its own corporate tax rules for firms operating inside its borders, although taxes are only levied on foreign gas or oil corporations. This is applicable for the branches of international banks operating in the UAE too.

However, all other companies established in the UAE are free from corporate taxes. This rule applies to all UAE jurisdictions (Onshore, Free Zone and Offshore). Therefore, VAT is the only type of taxation that may be encountered.

Excise tax – Excise taxes are imposed on some items that are known to be harmful to human health or the environment.

Value Added Tax – In 2018, the UAE introduced VAT at a rate of 5%. VAT (Value Added Tax) is a tax applied at each point of sale on the consumption or use of goods and services. And Value Added Tax is a type of indirect tax. Businesses are responsible for collecting and paying back taxes on behalf of the government.

*Most importantly, if a company’s taxable supplies and imports exceed AED 375,000 per year, it must register for VAT.

More details related to VAT:

- VAT consultancy in Dubai

- VAT/TAX filing services in Dubai

- Filing Tax on Time with the Tax consultants in Dubai

Are you a Tax Resident in Dubai?

Not everyone who reside in Dubai can enjoy a tax-free income. You may be subject to taxation on your income if you earn it in Dubai but live in another country. This is because most expats pay tax based on where they live.

Taxation based on your Tax Residency

- If you take a 6-month contract in Dubai and live and work in the emirate for only 6 months, you would most likely be considered an ordinary resident in your home country for tax reasons, and your earnings may be liable to taxation in your home country.

- If you live overseas and have an investment property in Dubai from which you receive a rental income, you must report this income on your tax return in the country of your tax residency and, if your entire earnings above the nil rate band for income tax, you may be required to pay tax on it.

- If you move to Dubai for a long period of time, or if you are away of your home country for a long period of time to qualify as a non-resident for tax reasons, then you may be able to earn your salary in Dubai 100% free of income taxation.

Other taxes in UAE

If you transfer property in the UAE, you will be charged a property tax of 4% in the Emirate of Dubai and 2% in the Emirate of Abu Dhabi.

KLOUDAC Accounting Firm Dubai, UAE

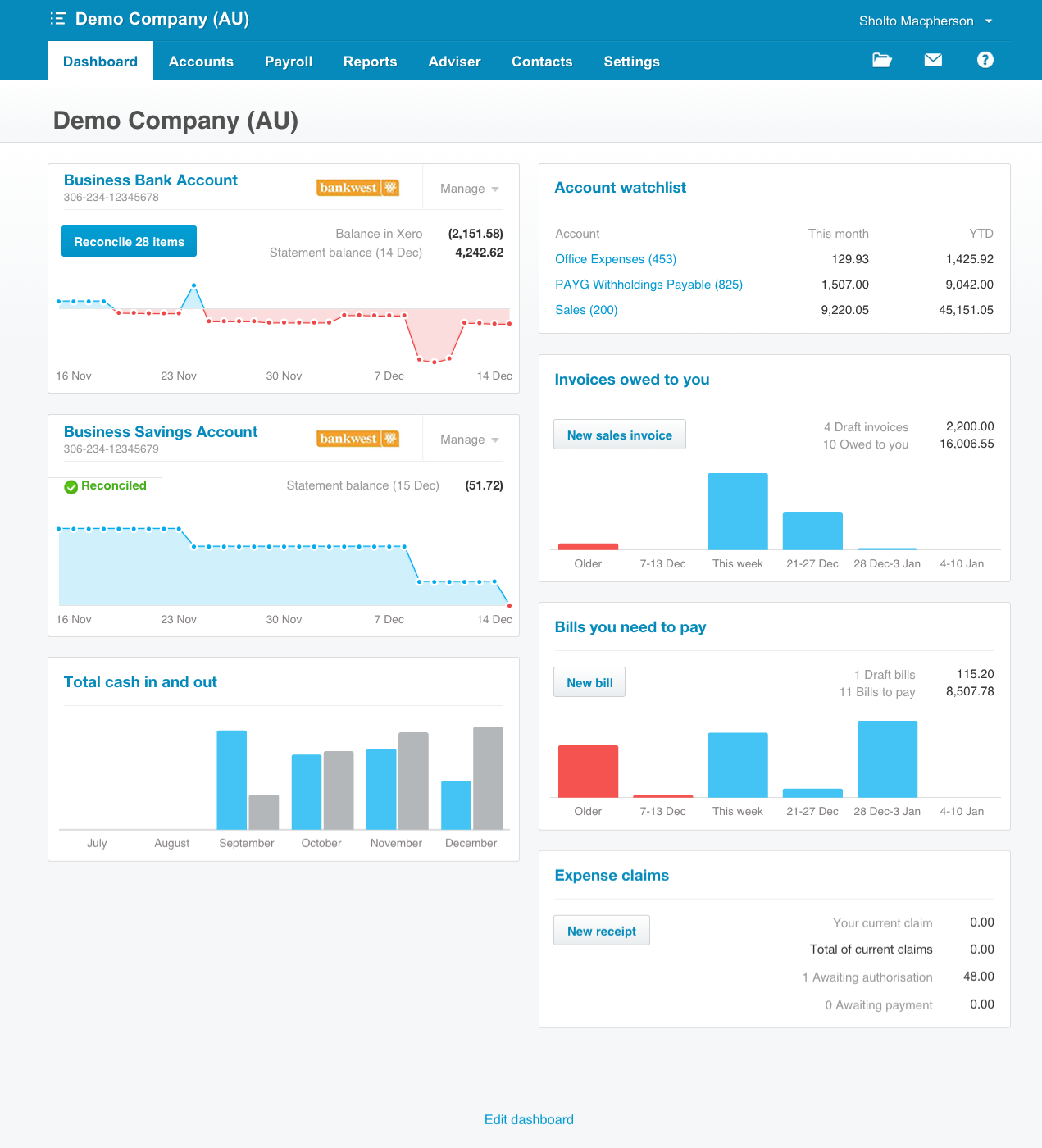

KLOUDAC is a recognized accounting firms in Dubai, UAE with 15 years of service experience. We have built connections with over 500 customers. It has also won the certification of Xero Payroll and certification of Xero advisor from the world leading online accounting software – XERO. Moreover, KLOUDAC is a golden champion partner of Xero.

Accounting and Bookkeeping is more convenient for the SMEs via KLOUDAC since they provide their clients with a whole package of services such as Financial Consultancy, Business setup, Audit and assurance services, Taxation services, Recognized accounting software and more.