What are financial reports?

Financial reporting is a common accounting practice in which financial statements are used to display a company’s financial information and performance over a certain period of time, usually annually or quarterly.

In simple terms, a financial report is necessary for understanding how much money you have, where it comes from, and where it needs to go.

Financial reporting enables managers to make informed business decisions based on the company’s financial health.

Potential investors and banks will look at your company’s financial reports to see whether they want to invest or lend you money.

What is the reason for keeping organized financial records?

Financial reports are used by businesses to compile accounting data and provide information about their current financial situation.

Many financial reports are accessible for public review, and they are used to forecast future profitability, industry position, and growth.

Financial reports are important since they fulfill several key objectives such as

-tracking cash flow

-evaluating assets and liabilities

-analyzing shareholder equity

-measuring profitability

Types of Financial Reports

Balance Sheet

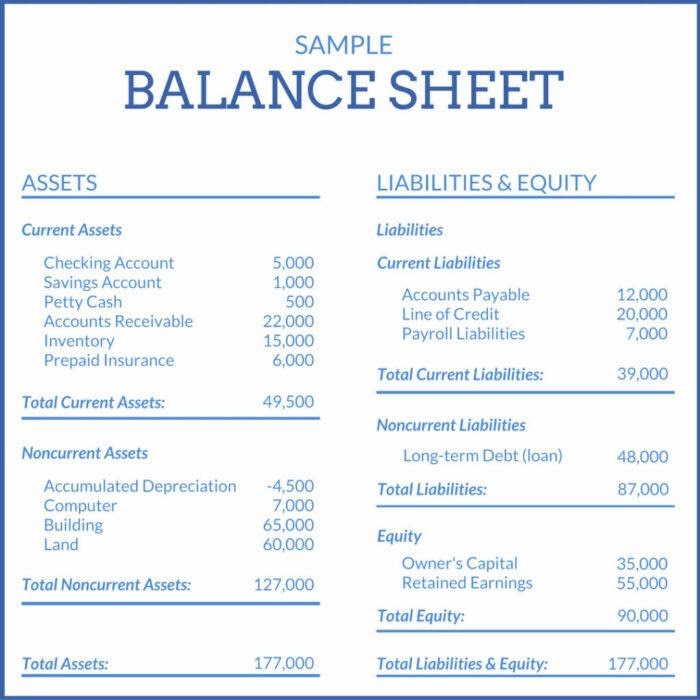

A balance sheet shows the assets, liabilities, and shareholders’ equity of a corporation at a specific point in time.

A simple look at the balance sheet will reveal total assets minus equity and liabilities. Balance sheets are often tracked quarterly, and data from balance sheets may be included in annual reports.

Your present asset liquidity and debt coverage are also assessed in real time using balance sheets.

Example:

Balance sheet displays the total assets, liabilities, and equity of the organization.

Shown below is an example.

Main use of the balance sheet is to indicate a company’s financial situation at a given moment in time. When the balance sheets for multiple consecutive periods are brought together, patterns in the various line items can be seen, this information becomes even more useful.

Income Statement

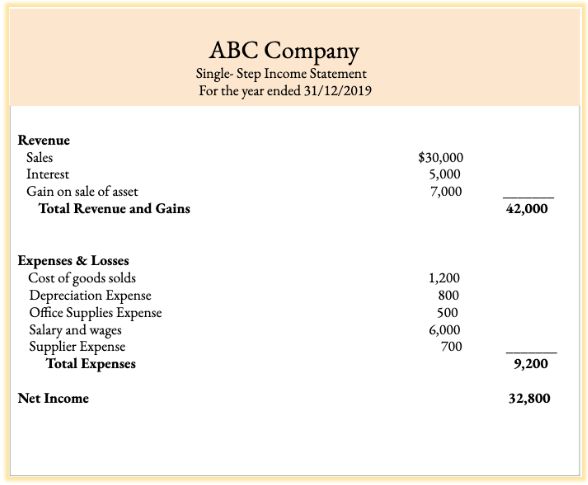

While a balance sheet examines current operations, an income statement examines them over a longer period of time. Some companies keep quarterly income statements and use them to track financial activities throughout the year.

The income statement shows sales, net income, expenses, and earnings per capital share when a firm issues stock on the stock exchange.

The income statement and the profit-and-loss statement are the same document for reporting earnings and losses.

Example:

Income statement displays the sales, revenue, expenses, and losses of the organization.

The income statement is used by research analysts to analyze year-over-year and quarter-over-quarter performance. One can determine if an organization’s efforts to lower the cost of deals benefited it in further growing benefits over time, or whether the administration worked out how to keep tabs on working expenses without sacrificing productivity.

Cash flow Statement

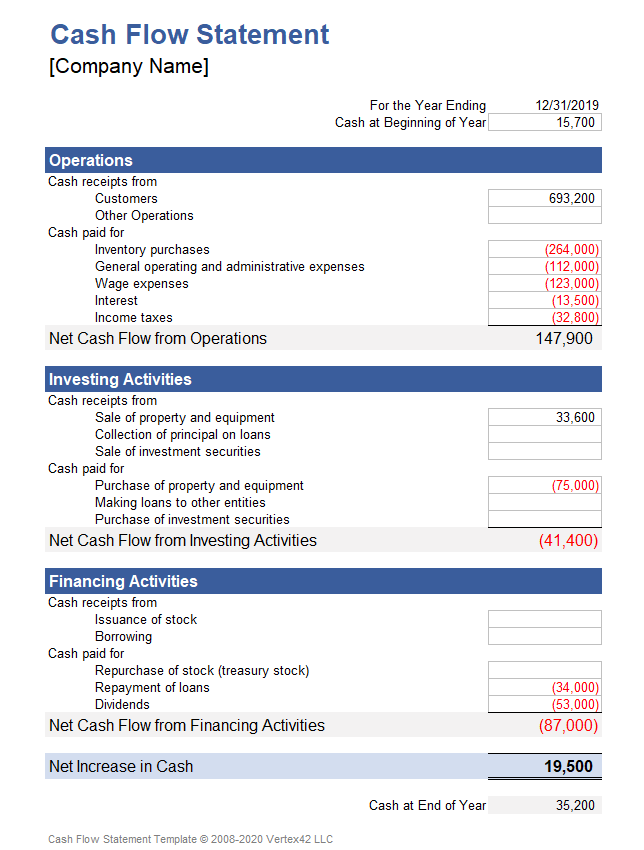

The cash flow statement is useful for determining how efficiently businesses earn cash to pay off debts.

Cash flow documentation also includes how successfully organizations fund operations and investments, as well as the continuing activities that create income to cover costs.

Understanding the efficiency of present procedures, spending activities, and income generation requires accurate cash flow statements.

Example:

Cash Flow statement shows the current operations, spending/ investing activities, and financing activities of the organization. Show below is an example statement of cash flow.

Cash flow statement is used to manage finances by tracking the cash flow for an organization. Cash Flow statements are extremely useful for the management to take informed decisions for regulating business operations.

KLOUDAC Accounting Firm Dubai, UAE

KLOUDAC is a recognized accounting firm in Dubai, UAE with 15 years of service experience. We have built connections with over 500 customers. It has also won the certification of Xero Payroll and certification of Xero advisor from the world leading online accounting software – XERO. Moreover, KLOUDAC is a golden champion partner of Xero. Accounting and Bookkeeping is more convenient for the SMEs via KLOUDAC since they provide their clients with a whole package of services such as Financial Consultancy, Business setup, Audit and assurance services, Taxation services, Recognized accounting software and more.