What is Bookkeeping?

Bookkeeping is one of the most important attributes to learn if you want to run a successful business since it allows you to keep track of your money on a daily and long-term basis.

Bookkeeping Tasks

Bookkeeping tasks must be completed on a daily, weekly, and monthly basis. Making simple modifications to your routines to remain on top of weekly bookkeeping responsibilities may be as easy as devising a method that fits for your work style and schedule.

Weekly Bookkeeping Tasks

Bookkeeping duties offer the records and analysis required to comprehend a company’s financials.

1. Bills to Enter and Pay

Small company expenditures may rapidly mount up due to utilities, rent, and invoicing from vendors. Vendors appreciate immediate payment and staying on top of your bills is a certain way to maintain a good reputation and manage your money.

While many bills are due on a monthly basis, others may be due as soon as they are received. As a result, it’s critical to check invoices regularly for inaccuracies, note the due date, and arrange payment accordingly. Paying early not only avoids late fines, but it also allows you to take advantage of early payment discounts.

It’s also easy to ensure that accounts have enough money when bills are recorded as a weekly bookkeeping activity.

Bill entry may be part of the everyday routine for larger firms.

2. Make your deposit

Small firms should make weekly contributions at the very least. Deposits can be done on a daily basis for firms that receive the majority of their payments in cash or paper checks.

It’s important to make timely deposits in order to keep your cash on hand and your records up to date.

Mobile deposits may be sufficient to handle the inflow of paper checks and avoid a trip to the bank for firms that predominantly accept electronic payments.

3. Invoices should be sent

Consumers and clients paying on time are critical to cash flow. To help reduce the amount and frequency of late payments, create and submit invoices every week rather than at the end of the month. Include a due date and payment terms to ensure that customers know how and when to pay you; this will help if you have clients that are known for being late with payments.

4. Organize your transactions into categories

Knowing where your company’s money is going is essential to budgeting. Organizing each cost into categories is a good approach to keep track of your spending. The categories used are determined by the sort of small business and its requirements. The following are some examples of potential categories:

Payroll

Employee advantages

Utilities

Payments for rent or a mortgage

Insurance

Weekly transaction categorization will aid in maintaining accurate records and highlighting any problems or red flags; it is more convenient if you can maintain them daily.

5. Make Entries in the Journal

Any financial transaction done by a firm should be accompanied by a diary entry in the general journal. This keeps track of a company’s transactions in a chronological order.

In most cases, business journal entries use the double-entry accounting system, which includes balancing debits and credits across accounts. Assets, liabilities, shareholder’s equity, costs, and income are the five categories of accounting in this system.

6. Examine your inventory

Small firms that sell things must keep track of their inventory and register it. A weekly inventory assessment will help you figure out when extra goods are needed. Having up-to-date stock information is also essential for detecting theft and informing staff when an item is back in stock, so they don’t lose out on possible sales.

Certain components of inventory management should be done more regularly than once a week to maintain stock information up to date. For firms with larger sales volume or perishable commodities, tracking inventory receipt and sale should be daily bookkeeping activities. Inventory management software that links with your bookkeeping software can help keep things simple.

7. Produce Reports

Creating financial reports should be on a small business’s must-do list when it comes to bookkeeping. Some reports benefit from being conducted daily, weekly, while others might be run monthly.

Daily

Daily transactions for both customer and internal accounts should be maintained on a daily basis. Sales, costs, and payments are examples of such transactions. It will be important to keep track of transactions.

Records and files should be maintained daily. Receipts, invoices, and reports should be filed daily so that your documents are well organized.

Weekly

Accounts Receivable: This report shows how much money a small business owes them, such as unpaid bills. Following up on late payments in a timely manner can be aided by keeping track of accounts receivable on a weekly basis.

Examining how much of each product you’re selling is essential for making short-term decisions.

Monthly

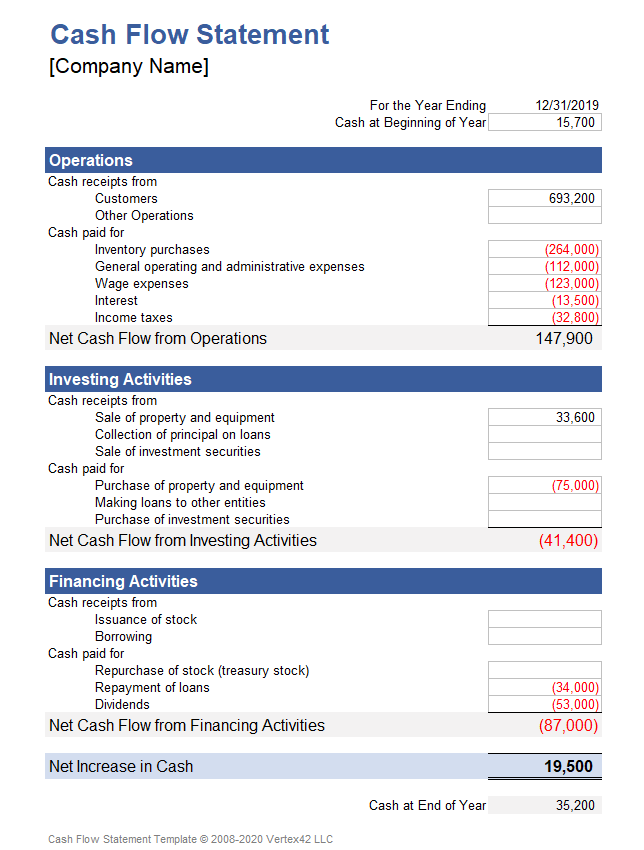

Cash Flow Statement: This document assesses a company’s cash flow management, which may be defined as its capacity to create cash to pay debts and meet operational expenditures. It’s beneficial.

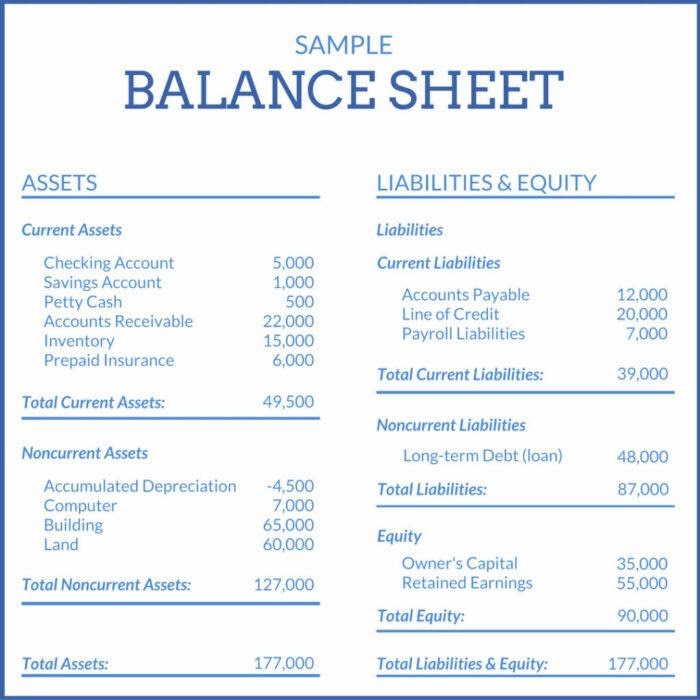

Accounts Payable: This statement summarizes a company’s assets, liabilities, and equity in order to provide a snapshot of its financial position at a given point in time. A balance sheet may illustrate a company’s debt-to-asset ratio and net value at a glance.

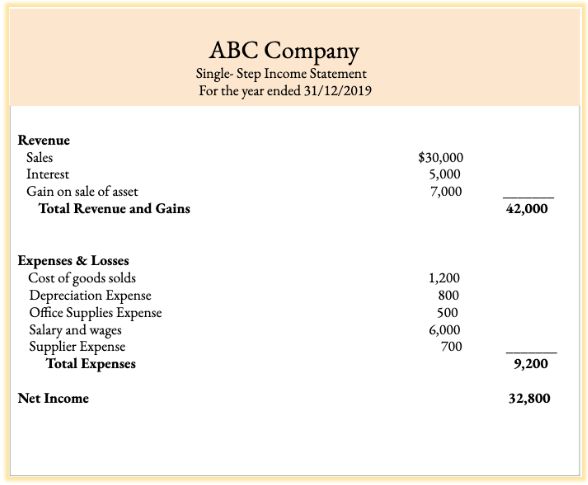

The profit and loss statement: indicates how much money a company has made after all expenditures have been deducted. Because many costs, such as electricity and rent, are paid monthly, a profit and loss statement prepared once a month will provide a more realistic view of a company’s bottom line.

8. Examine the timesheets

Small businesses with employees must incorporate payroll in their bookkeeping. Employee timesheets are checked once a week to keep track of their hours worked, which makes payroll calculations for compensation, tax deductions, and accrual of benefits like vacation and sick days much easier.

Payroll management software may be quite beneficial in this regard, and the majority of the major solutions link with popular accounting software like QuickBooks and Xero. There are even free payroll applications available to assist you with simple chores. The more processes you automate, the easier it will be to maintain track of your finances on a weekly basis.

9. Bank Accounts Should Be Reconciled Daily and Weekly

Businesses may balance their bank accounts daily or weekly rather than waiting for a monthly bank statement. Businesses may compare their bank account balance to their book balance as often as they desire by simply connecting into an online bank interface. Weekly auditing allows organizations to quickly rectify any irregularities and discover fraud before it becomes a bigger problem.

KLOUDAC Accounting Firm Dubai, UAE

KLOUDAC is a recognized accounting firm in Dubai, UAE with 15 years of service experience. We have built connections with over 500 customers. It has also won the certification of Xero Payroll and certification of Xero advisor from the world leading online accounting software – XERO. Moreover, KLOUDAC is a golden champion partner of Xero. Accounting and Bookkeeping is more convenient for the SMEs via KLOUDAC since they provide their clients with a whole package of services such as Financial Consultancy, Business setup, Audit and assurance services, Taxation services, Recognized accounting software and more.