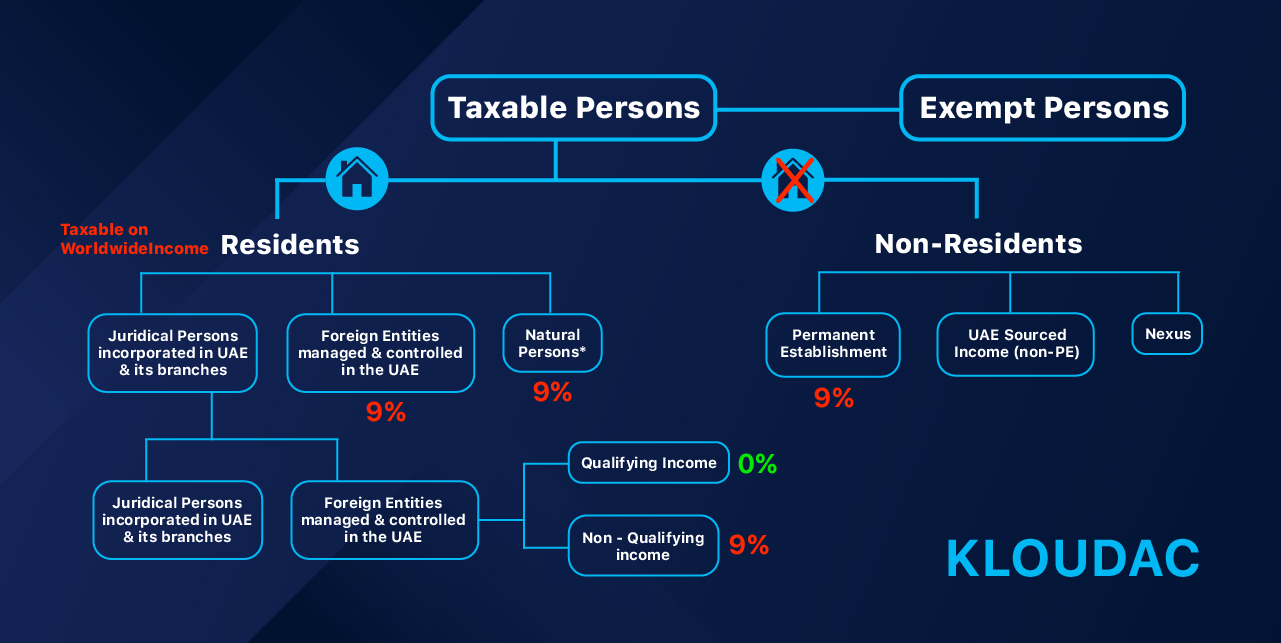

This blog post delves into the corporate tax landscape in the United Arab Emirates (UAE) – a thriving financial hub in the Middle East for local and international businesses. While the UAE offers a tax-friendly environment with no federal corporate income tax, it emphasizes the importance of understanding the tax landscape for businesses operating in the region. The blog explores two categories of entities concerning corporate tax: taxable persons and exempt persons.

Taxable Persons: Foreign companies operating in the UAE, either through a permanent establishment or branch, may be subject to corporate tax based on emirate-specific regulations. Despite enjoying a tax-free environment on the mainland, free zone companies may be subject to certain tax measures introduced to align with international standards.

Exempt Persons: Onshore companies (mainland companies) are exempt from federal corporate income tax but are subject to local taxes imposed by individual emirates, including municipal and property taxes. Offshore companies in specific free zones known as International Financial Centers are granted total exemption from corporate income tax for extended periods, attracting international investors for various non-operational activities.

Read more on the topic “Corporate Tax” with our previous blog posts:

KLOUDAC Accounting Firm Dubai, UAE

The UAE’s unique and advantageous corporate tax landscape promotes investment, innovation, and entrepreneurship. However, businesses are advised to stay updated with the specific tax regulations in their emirate of operation and seek guidance from tax experts and legal advisors like KLOUDAC. Embracing the opportunities offered by this tax-friendly nation can lead to successful business ventures in the heart of the Middle East.