Bank guarantees are essential to the business environment because they give participants transactions assurance and financial stability. Bank guarantees are frequently employed in the United Arab Emirates (UAE) to safeguard the interests of numerous parties, including people, companies, and governmental organizations. This page aims to give a thorough overview of bank guarantee providers in the UAE, including their types, advantages, and common users.

What are Bank Guarantees?

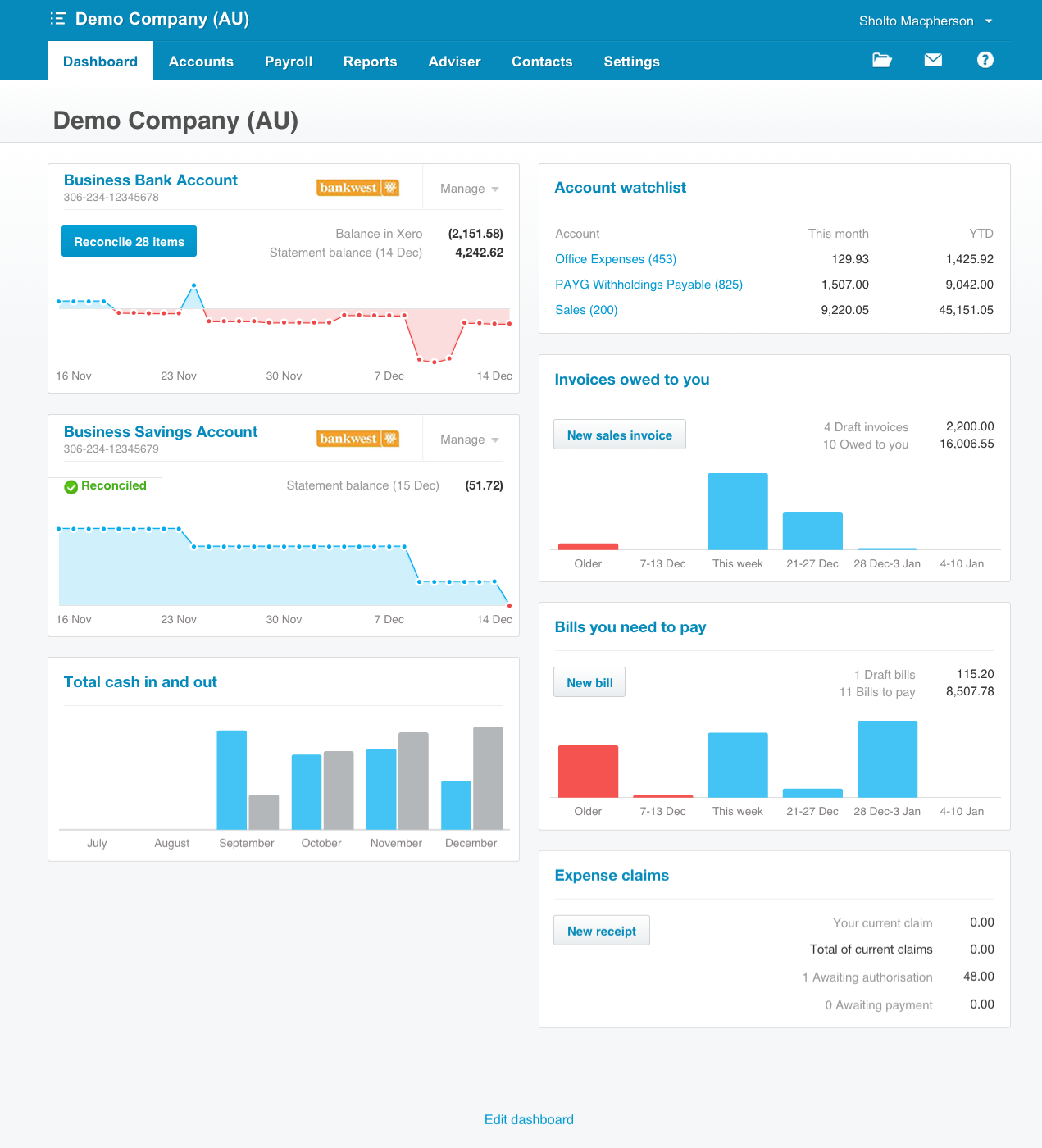

A bank guarantee is a legally binding agreement issued by a bank on behalf of a customer (the applicant) to ensure that certain obligations are fulfilled. It serves as a commitment from the bank to make a specified payment to a beneficiary in the event that the applicant fails to meet its obligations or fulfill a contractual agreement. Bank guarantees in Dubai act as a form of financial security, mitigating risks and instilling confidence in transaction parties.

Types of Bank Guarantees in the UAE

The Dubai banking system offers various types of bank guarantees to cater to the diverse needs of individuals and businesses. Some common types of bank guarantees in the UAE include:

1. Performance Guarantees: Performance guarantees are issued to ensure that contractors or suppliers fulfill their contractual obligations according to the agreed terms and conditions. In construction projects, for example, a performance guarantee may be required to ensure timely completion, adherence to quality standards, and proper execution of the project.

2. Bid/Tender Guarantees: When participating in a tender or bidding process, a bid/tender guarantee is often required. It assures the tendering entity that the bidder will sign the contract and provide the necessary performance guarantee if awarded the contract.

3. Advance Payment Guarantees: In situations where a buyer makes an advance payment to a seller, such as in the case of import/export transactions, an advance payment guarantee is often requested. This guarantee ensures that the advance payment will be refunded if the seller fails to deliver the goods or services as per the agreed terms.

4. Retention Money Guarantees: Construction and infrastructure projects frequently involve withholding a certain percentage of the contract value as retention money until the completion of the project. A retention money guarantee assures the contractor that the retained amount will be released upon successful project completion.

5. Financial Guarantees: Financial guarantees are issued to secure financial obligations, such as loans, leases, or credit facilities. These guarantees provide assurance to the lender or lessor that the borrower or lessee will fulfill their financial obligations as agreed.

Benefits of Bank Guarantees in Dubai

Bank guarantees offer several benefits to parties involved in transactions in the UAE:

1. Risk Mitigation: Bank guarantees provide a safety net by reducing the risk associated with financial transactions. They ensure that the other party is financially protected if one party fails to meet its obligations.

2. Enhanced Credibility: By providing a bank guarantee, the applicant demonstrates its financial strength and commitment to fulfill its obligations. This increases its credibility and trustworthiness in the eyes of the beneficiary.

3. Facilitates International Trade: Bank guarantees are essential in cross-border transactions as they provide assurance to foreign buyers or sellers. They help mitigate risks associated with unfamiliar markets, cultural differences, and potential payment defaults.

4. Contractual Protection: Bank guarantees act as a legally binding contract, offering protection to both the applicant and the beneficiary. They provide recourse in case of non-compliance or breach of contract.

Who can use Bank Guarantees in UAE?

1. Contractors: Construction businesses, contractors, and suppliers often need bank guarantees for project execution. These guarantees assure project owners and clients that contractors and suppliers will fulfill their contractual responsibilities.

2. Government Entities: UAE government entities often seek bank guarantees when issuing contracts or signing agreements with contractors, suppliers, or service providers. Guarantees that rewarded parties fulfill their duties defend the government’s interests.

3. Importers and Exporters: International trade transactions sometimes use bank guarantees. Importers may obtain advance payment assurances for international suppliers. Exporters may seek guarantees to assure consumers of their delivery.

4. Real Estate Developers: Builders may obtain bank guarantees from buyers to secure their property purchases. These guarantees protect developers’ finances and ensure buyers’ contractual commitments.

5. Financial Institutions: Banks and financial institutions can use bank guarantees for business. Banks may guarantee credit, loans, and leases. Certain financial services may demand consumer assurances.

6. Trading Companies: Trading, distribution, and supply chain companies typically use bank guarantees. Suppliers or consumers may need these payment, delivery, or contractual compliance guarantees.

To Sum Up-

Bank guarantee providers in Dubai are integral to the business landscape in the UAE, providing financial security and assurance to individuals, businesses, and government entities. They serve as a vital risk mitigation tool, enabling parties involved in transactions to protect their interests. With bank guarantees in the UAE, individuals and businesses can navigate the complexities of commercial transactions with greater confidence and security.