Accounting software assists small business owners in keeping track of their payables and receivables, evaluating their profitability, and preparing for tax season. Small firms frequently don’t need to make major customizations to accounting software that comes out of the box. As a company expands, its accounting requirements get more sophisticated, necessitating the use of a personalized enterprise resource planning (ERP) system.

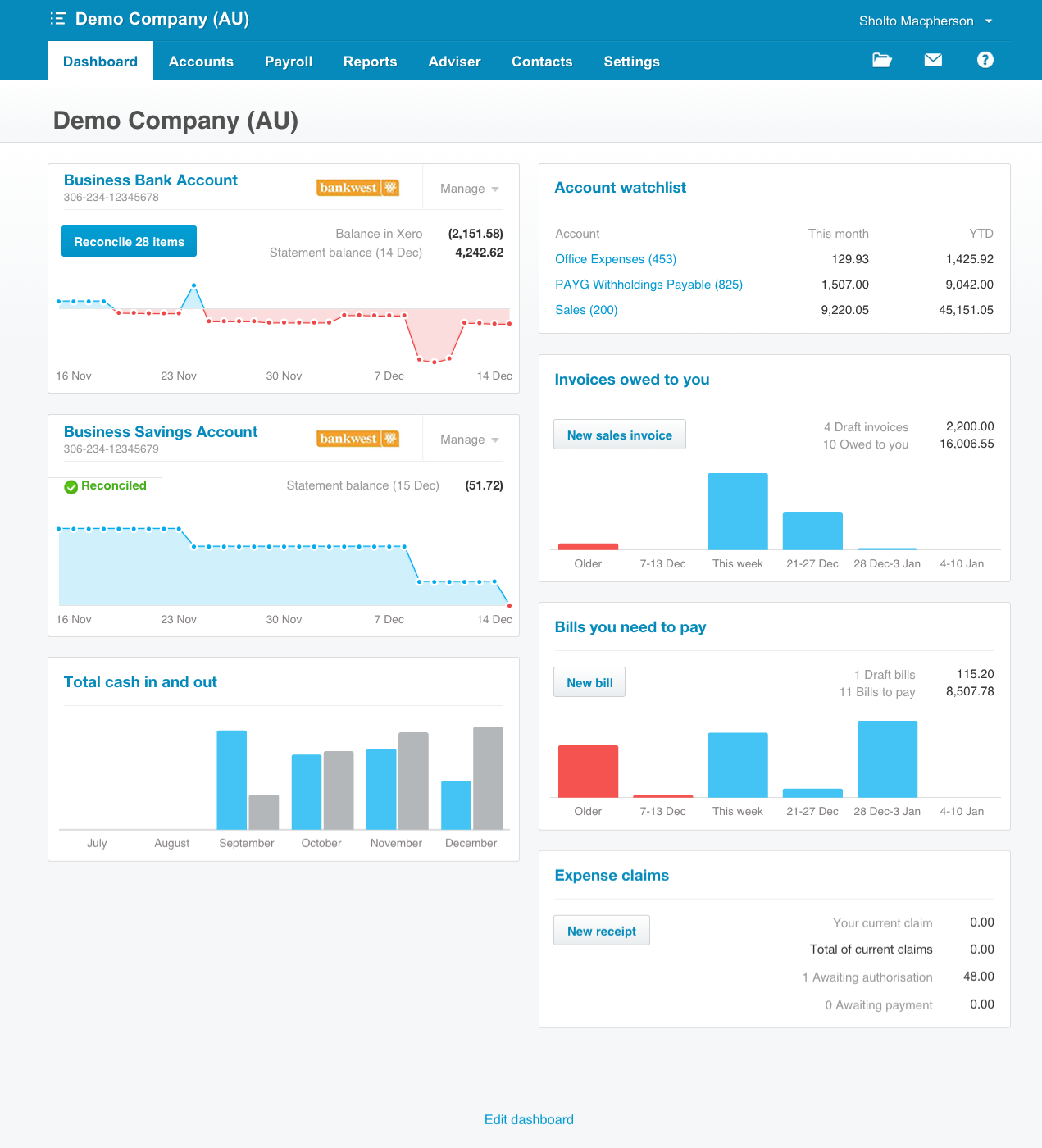

Xero

This software fully interacts with a third-party payroll service and offers a simple user interface. Through Xero’s interface with Stripe and GoCardless, businesses can accept online payments from clients.

Quickbooks

QuickBooks Online is not only used by the majority of small business accounting specialists but there are also countless online training materials and forums where you can obtain support when you need it. One central dashboard provides easy access to all accounting elements, facilitating more flexible and effective bookkeeping.

FreshBooks

Compared to other accounting software, FreshBooks provides greater customizations for invoicing. Its main purpose is to send, receive, print, and pay invoices, but it can also take care of a business’s essential bookkeeping requirements. Sending bids, keeping track of project time, and being paid are all made simpler for service-based firms thanks to this accounting software.

Wave

A service-based small firm that issues straightforward invoices and doesn’t require payroll management finds Wave to be the perfect accounting software platform. At year’s end, accountants can get the Wave reports they need to create a company’s tax return.

| Software | Advantages |

| Xero | – Has mobile app – Payroll integration with Gusto – Third-party app marketplace |

| Quickbooks | – Commonly used by accounting professionals – Integration with third-party applications – Has mobile app |

| FreshBooks | – Third-party app integration – Affordable – Advanced invoicing features |

| Wave | – Free accounting, invoicing, and receipt scanning – No transaction or billing limits – Run multiple businesses in one account |

KLOUDAC Accounting Firm Dubai, UAE

Accounting software may assist small firms with a variety of tasks, such as handling tax season and controlling their costs. However, every company is unique. Numerous certified accounting software programs are available from and supported by KLOUDAC.